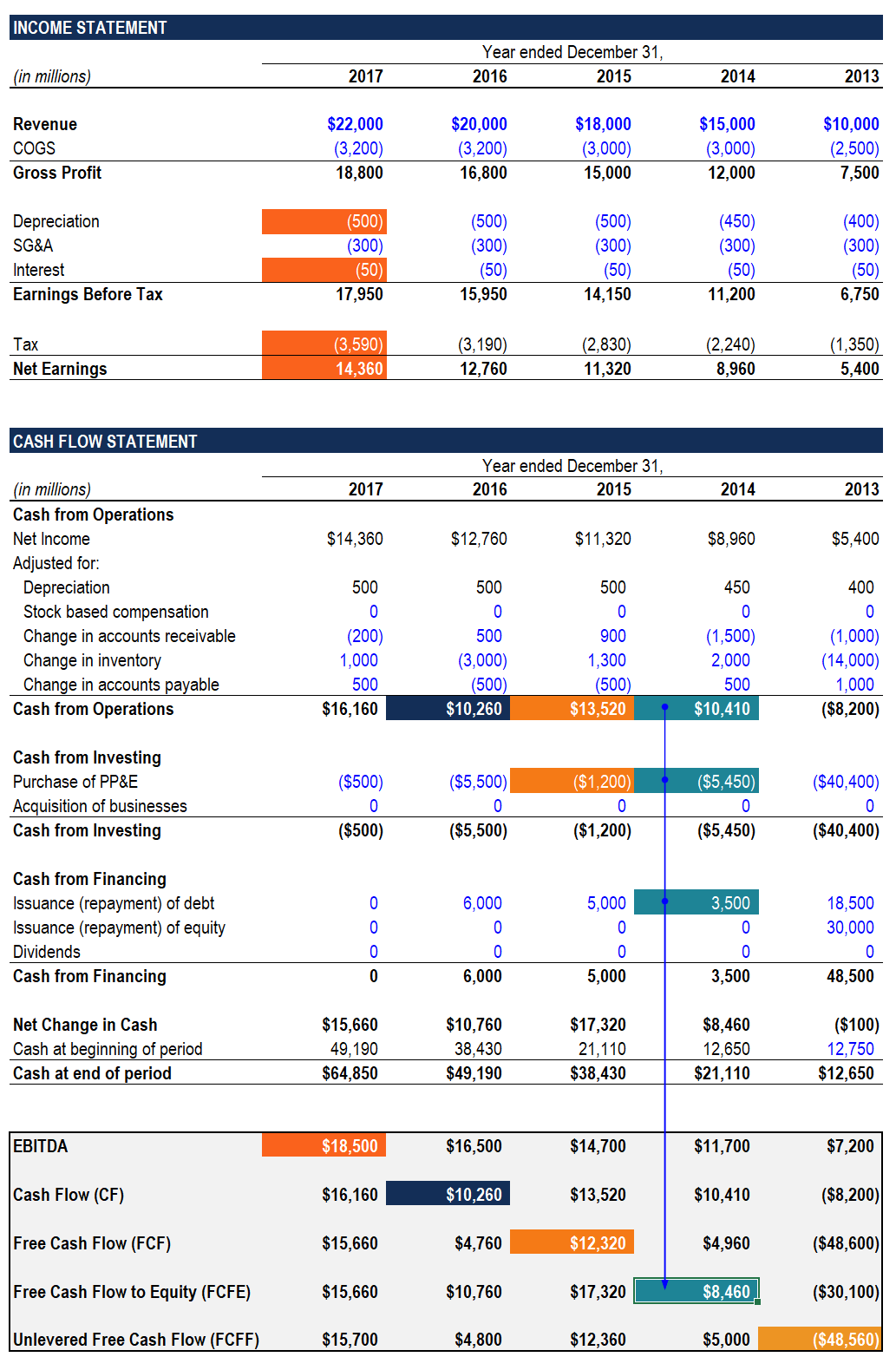

Free cash flow or FCF can be described as a firms cash flow or equity post the payment of all debt and related financial obligations. When a firms share price is low and free cash flow is on the rise the. Free cash flow to the firm FCFF shows the amount of cash flow from operations that is available for distribution after accounting for depreciation expenses working capital taxes and investments. Discounted free cash flow for the firm FCFF should be equal to all of the cash inflows and outflows adjusted to present value by an appropriate interest rate that the firm. Free cash flow to the firm FCFF represents the cash flow from operations available for distribution after accounting for depreciation expenses taxes working capital and investments. Net income Non-cash charges Interest Tax Rate Long-term Investments and Investments in Working Capital Free cash flow to the firm has been called the most important financial indicator of a companys stock value. Free cash flow to the firm FCFF shows the amount of cash flow from operations that is available for distribution after accounting for depreciation expenses working capital taxes and investments. Free cash flow FCF is cash left after a company pays operating expenses and capital expenditures. Free cash flow to the firm FCFF and free cash flow to equity FCFE are the cash flows available to respectively all of the investors in the company and to common stockholders. Analysts like to use free cash flow either FCFF or FCFE as the return.

Free cash flow to the firm FCFF and free cash flow to equity FCFE are the cash flows available to respectively all of the investors in the company and to common stockholders. Discounted free cash flow for the firm FCFF should be equal to all of the cash inflows and outflows adjusted to present value by an appropriate interest rate that the firm. If the company is not paying dividends. Free Cash Flow to Equity is also used in financial modelling for determining the equity value of a firm. When a firms share price is low and free cash flow is on the rise the. Free Cash Flow to the Firm. N Valuation of Firm Value of operating assets 2957 056-03 112847 mil DM Cash Marketable Securities 18068 mil DM Value of Firm 130915 mil DM - Debt Outstanding 64488 mil DM Value of Equity 66427 mil DM Value per Share 727 DM per share Stock was. Free cash flow FCF is the cash flow available for the company to repay creditors or pay dividends and interest to investors. Analysts like to use free cash flow either FCFF or FCFE as the return. Free cash flow to the firm FCFF shows the amount of cash flow from operations that is available for distribution after accounting for depreciation expenses working capital taxes and investments.

Net income Non-cash charges Interest Tax Rate Long-term Investments and Investments in Working Capital Free cash flow to the firm has been called the most important financial indicator of a companys stock value. Free Cash Flow to the Firm. Free cash flow to the firm FCFF and free cash flow to equity FCFE are the cash flows available to respectively all of the investors in the company and to common stockholders. Free cash flow or FCF can be described as a firms cash flow or equity post the payment of all debt and related financial obligations. Free cash flow FCF is the cash flow available for the company to repay creditors or pay dividends and interest to investors. When a firms share price is low and free cash flow is on the rise the. Free cash flow FCF is cash left after a company pays operating expenses and capital expenditures. Some investors prefer FCF or FCF per share over earnings or earnings. Analysts like to use free cash flow either FCFF or FCFE as the return. Free Cash Flow to Equity is also used in financial modelling for determining the equity value of a firm.

Free Cash Flow to the Firm. The formula for free cash flow to the firm requires the following 6 variables. Discounted free cash flow for the firm FCFF should be equal to all of the cash inflows and outflows adjusted to present value by an appropriate interest rate that the firm. Analysts like to use free cash flow either FCFF or FCFE as the return. N Valuation of Firm Value of operating assets 2957 056-03 112847 mil DM Cash Marketable Securities 18068 mil DM Value of Firm 130915 mil DM - Debt Outstanding 64488 mil DM Value of Equity 66427 mil DM Value per Share 727 DM per share Stock was. Free Cash Flow to Equity is also used in financial modelling for determining the equity value of a firm. Free cash flow to the firm FCFF represents the cash flow from operations available for distribution after accounting for depreciation expenses taxes working capital and investments. Free cash flow FCF is the cash flow available for the company to repay creditors or pay dividends and interest to investors. Free cash flow to the firm FCFF shows the amount of cash flow from operations that is available for distribution after accounting for depreciation expenses working capital taxes and investments. Free Cash Flow to Equity is also used in financial modelling for determining the equity value of a firm.

Free Cash Flow to Equity is also used in financial modelling for determining the equity value of a firm. Free cash flow FCF is the cash flow available for the company to repay creditors or pay dividends and interest to investors. The formula for free cash flow to the firm requires the following 6 variables. Discounted free cash flow for the firm FCFF should be equal to all of the cash inflows and outflows adjusted to present value by an appropriate interest rate that the firm. Free cash flow to the firm FCFF shows the amount of cash flow from operations that is available for distribution after accounting for depreciation expenses working capital taxes and investments. Net income Non-cash charges Interest Tax Rate Long-term Investments and Investments in Working Capital Free cash flow to the firm has been called the most important financial indicator of a companys stock value. Free cash flow FCF is cash left after a company pays operating expenses and capital expenditures. Some investors prefer FCF or FCF per share over earnings or earnings. Free cash flow to the firm FCFF shows the amount of cash flow from operations that is available for distribution after accounting for depreciation expenses working capital taxes and investments. Free cash flow to the firm FCFF and free cash flow to equity FCFE are the cash flows available to respectively all of the investors in the company and to common stockholders.