The interest paid on a note payable is reported in the section of the cash flow statement entitled cash flows from operating activities. What Does the Increase in Notes Receivable Do to Cash Flow. Assets Liabilities Stockholders Equity Cash Noncash Assets Liabilities SE Cash L SE NCA Cash L SE NCA This means that we can evaluate changes in cash by. However there are two different methods businesses can use to track accounts payables and accounts receivables. The increase in accounts receivables is deducted from Net Profit and the decrease in accounts receivables is added to Net Profit. Cash equivalents are highly liquid shortterm investments that usually mature within three months of their purchase. The financing section of the cash flow statement may have a separate notes payable section to capture this information. The cash flow statement is divided into three. Indirect Method The indirect method uses changes in balance sheet accounts to reconcile net income to cash flows from operations. A scenario in which a company.

Operating investing and financing. This is because businesses need to record accounts payable and accounts receivable which can make tracking cash flow accurately a bit challenging. As noted above the cash inflows and outflows are divided into three sections plus a cash section based on the balance sheet accounts underlying the cause or nature of the cash flows. What Does the Increase in Notes Receivable Do to Cash Flow. The interest paid on a note payable is reported in the section of the cash flow statement entitled cash flows from operating activities. The Statement of Cash Flows also referred to as the cash flow statement is one of the three key financial statements that report the cash generated and spent during a specific period of time eg a month quarter or year. The operating section is where cash flow from the companys day-to-day activities is recorded. Statement of cash flows. Treasury bills money market funds and commercial paper are usually classified as cash equivalents. Each method is represented differently on the cash flow statement.

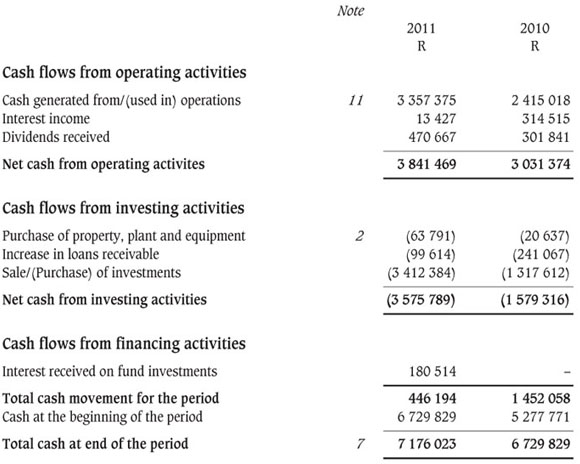

The statement of cash flows explains the changes in the balance sheet during an accounting period from the perspective of how these changes affect cash. 7 Level of Learning. The operating section is where cash flow from the companys day-to-day activities is recorded. What Does the Increase in Notes Receivable Do to Cash Flow. The financing section of the cash flow statement may have a separate notes payable section to capture this information. The principal amount from a long-term loan or note payable usually appears in the financing activities section of the cash flow statement once the organization receives the money from the lender. To put it simply if we RECEIVE CASH in the transaction we ADD the cash amount received and if we PAY CASH in. Add up any money received from the sale of assets paying back loans or the sale of stocks and bonds. What Does the Increase in Notes Receivable Do to Cash Flow. A cash flow statement is a financial statement that summarizes the amount of cash and cash equivalents entering and leaving a company.

Cash Flow Statement. The financing section of the cash flow statement may have a separate notes payable section to capture this information. The operating section is where cash flow from the companys day-to-day activities is recorded. What Does the Increase in Notes Receivable Do to Cash Flow. 7 Level of Learning. Each method is represented differently on the cash flow statement. The cash flow statement is divided into three. Cash equivalents are highly liquid shortterm investments that usually mature within three months of their purchase. Operating investing and financing. The statement of cash flows explains the changes in the balance sheet during an accounting period from the perspective of how these changes affect cash.

The operating section is where cash flow from the companys day-to-day activities is recorded. Add up any money received from the sale of assets paying back loans or the sale of stocks and bonds. 7 Level of Learning. What Does the Increase in Notes Receivable Do to Cash Flow. To put it simply if we RECEIVE CASH in the transaction we ADD the cash amount received and if we PAY CASH in. Treasury bills money market funds and commercial paper are usually classified as cash equivalents. The statement of cash flows explains the changes in the balance sheet during an accounting period from the perspective of how these changes affect cash. Flow of a company is found on the cash flow statement. This is because businesses need to record accounts payable and accounts receivable which can make tracking cash flow accurately a bit challenging. The cash flow of a company is found on the cash flow statement.