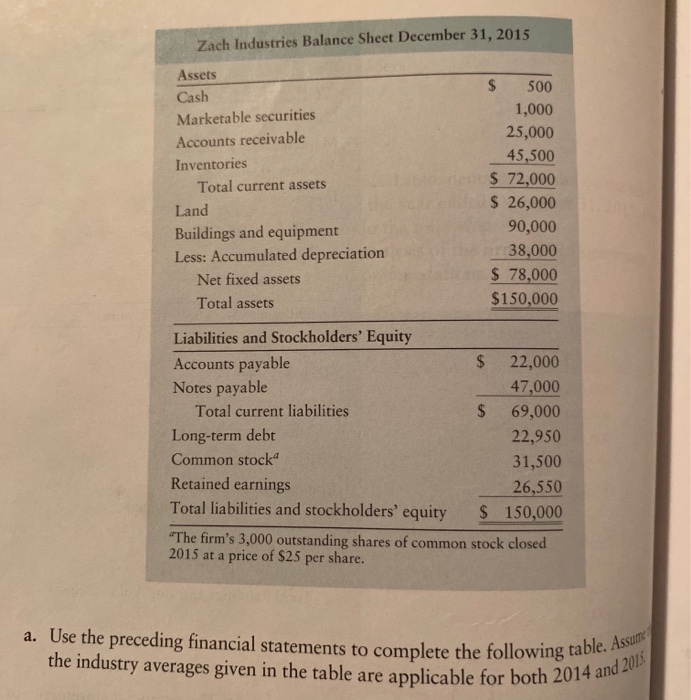

Summarize the companys overall financial condition. Academiaedu is a platform for academics to share research papers. Cost of goods sold 106000 Gross profits 54000 Less. Average collection period. Operating expenses S 16000 10000 1000 10000 37000 S 17000 Selling expense General and administrative expenses Lease expense Total operating expense Operating profits Net profits before taxcs Net profits after taxes Zach Industries. Analyze Zach Industries financial condition as it is related to X liquidity 2 activity 3 debt 4 profitability and 5 market. Ratio Industry Average Current ratio 18 Quick ratio 070 Inventory turnovera 250 Average collection perioda 375 Days Debt ratio 65 67 65 Times interest earned ratio 38 40 38 Gross profit margin 38 40 38 Net profit margin 35 36 350 Return on total assets 40 40 40. Operating expenses Selling expense General and administrative expenses Lease. Zach Industries Income Statement for the Year Ended December 31 2019 160000 106000 54000 Sales revenue Less. Price per share 25 Industry Actual Actual Zach Industries Ratio Analysis Average 2018 2019 Current ratio 180 184 104 Quick ratio 070 078 038 Inventory turnover 250 259 233 Average collection period days 375 365 570 Debt ratio 650 670 61300 Times interest earned 38 40 28 Gross profit margin 38 40 34.

Their database is 700 industries strong and compiles data from documents such as balance sheets income statement line items and close to 19 different ratios. Zach Industries Income Statement for the Year Ended December 31 2012 Zach Industries Income Statement for the Year Ended December 31 2012 Sales revenue 160000 Less. The ratio gives an investor an easy way to compare one companys earnings with those of other companies. Zach Industries Ratio Analysis Industry Average Actual Actual 2014 2015 Current ratio 180 184 104 Quick ratio 070 078 038 Inventory turnover 250 259 233 Average collection period 375 days 365 days 57 days Debt ratio 65 67 613 Times interest earned 38 40 28 Gross profit margin 38 40 34 Net profit margin 35 36 41 Return on. Analyze Zach Industries financial condition as it is related to X liquidity 2 activity 3 debt 4 profitability and 5 market. Ratio Analysis Financial statement analysis of Zach Industries. Zach Industries Ratio Analysis Industry Average Actual 2014 Actual 2015 Current ratio 18 184 104 Quick ratio 07 078 038 Inventory turnover 25 259 233 Average collection period 375 days 36. Cost of goods sold 106000 Gross profits 54000 Less. Operating expenses S 16000 10000 1000 10000 37000 S 17000 Selling expense General and administrative expenses Lease expense Total operating expense Operating profits Net profits before taxcs Net profits after taxes Zach Industries. Gain free stock research access to stock picks stock.

Cost of goods sold 106000 Gross profits 54000 Less. Zach Industries Income Statement for the Year Ended December 31 2012 Sales reven Less. Ratio analysis the financial statements of zach industries for the year ended december 31 2009 follow. Interest coverage ratio. Cost of goods sold Gross profits Less. Zach Industries Ratio Analysis Industry Average Actual 2014 Actual 2015 Current ratio 18 184 104 Quick ratio 07 078 038 Inventory turnover 25 259 233 Average collection period 375 days 36. Zach Industries Income Statement for the Year Ended December 31 2012 Zach Industries Income Statement for the Year Ended December 31 2012 Sales revenue 160000 Less. Ratio Analysis Financial statement analysis of Zach Industries. P3-24 Financial statement analysis The financial statements of Zach Industries for the year ended December 31 2019 follow. The ratio is important for investors and risk analysis.

Interest coverage ratio. Using the companies from the above example suppose ABC has a PE ratio. It is the only source of financial ratio benchmarks directly derived from over 250000 financial statements of contributing member clients. P3-24 Financial statement analysis The financial statements of Zach Industries for the year ended December 31 2019 follow. Cost of goods sold 160000 106000 S 54000 Gross profits Less. Author webuser Posted on November 19 2015 Post navigation. Summarize the companys overall financial condition. The ratio gives an investor an easy way to compare one companys earnings with those of other companies. Average collection period. Can someone help me with this homework.

Cost of goods sold 160000 106000 S 54000 Gross profits Less. Their database is 700 industries strong and compiles data from documents such as balance sheets income statement line items and close to 19 different ratios. Zach industries income statements for the year ended. Health care organizations with heavy long-term debt loads and low available capital and asset values present a risky business model. Author webuser Posted on November 19 2015 Post navigation. Management can use this ratio to locate opportunities for new capital expansions debt reduction and strategic asset management that will increase the sustainability and long-term profit potential for the. Ratio Analysis Financial statement analysis of Zach Industries. Zacks is the leading investment research firm focusing on stock research analysis and recommendations. Using the companies from the above example suppose ABC has a PE ratio. Analyze Zach Industries financial condition as it is related to X liquidity 2 activity 3 debt 4 profitability and 5 market.