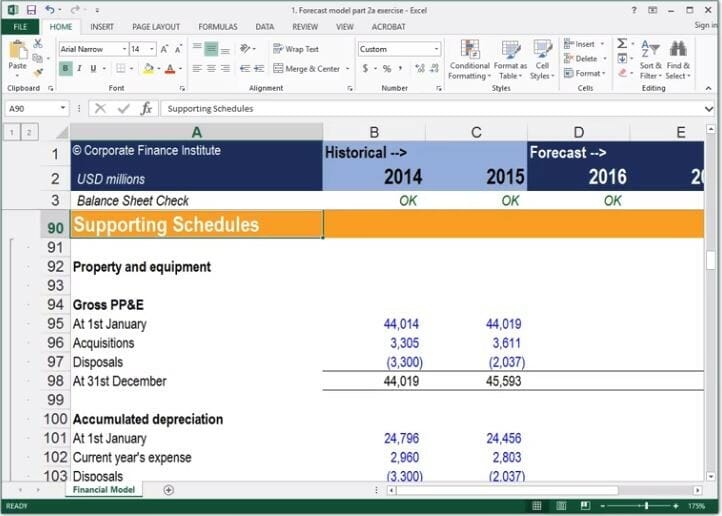

What it owns the liabilities ie. Coca Cola Co Balance Sheet Annual. See more Zacks Equity Research reports. The balance sheet is a financial report that shows the assets of a business ie. This guide breaks down step-by-step how to calculate and then forecast each of the line items necessary to forecast a complete balance sheet and build a 3 statement financial model 3 Statement Model A 3 statement model links the income statement balance sheet and cash flow statement into one dynamically connected financial model. Liabilities are the sum which company is obliged to pay. Select the Financial Report. Financial reporting quality relates to the accuracy with which Coca-Cola Cos reported financial statements reflect its operating performance and to their usefulness for forecasting future cash flows. This article aims to provide readers with an easy to follow step-by-step guide to forecasting balance sheet items in a financial model in Excel including property plant and equipment PPE PPE Property Plant and Equipment PPE Property Plant and Equipment is one of the core non-current assets found on the balance sheet. The difference between assets and liabilities.

Aggregate accruals deriving measures of the accrual component of Coca-Cola Cos earnings. The balance sheet is a financial report that shows the assets of a business ie. This article aims to provide readers with an easy to follow step-by-step guide to forecasting balance sheet items in a financial model in Excel including property plant and equipment PPE PPE Property Plant and Equipment PPE Property Plant and Equipment is one of the core non-current assets found on the balance sheet. THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS December 31 2017 2016 In millions except par value ASSETS CURRENT ASSETS Cash and cash equivalents 6006 8555 Short-term investments 9352 9595 TOTAL CASH CASH EQUIVALENTS AND SHORT-TERM INVESTMENTS 15358 18150 Marketable securities 5317 4051 Trade accounts. In reviewing each line item I will define Cokes balance sheet line item such as cash property plant. COKE Coca-Cola Consolidated Inc. Dow Jones a News Corp company. See more Zacks Equity Research reports. Forecasting Balance Sheet Items in a Financial Model. Learn more about Zacks Equity Research reports.

In reviewing each line item I will define Cokes balance sheet line item such as cash property plant. Financial reporting quality relates to the accuracy with which Coca-Cola Cos reported financial statements reflect its operating performance and to their usefulness for forecasting future cash flows. THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS December 31 2017 2016 In millions except par value ASSETS CURRENT ASSETS Cash and cash equivalents 6006 8555 Short-term investments 9352 9595 TOTAL CASH CASH EQUIVALENTS AND SHORT-TERM INVESTMENTS 15358 18150 Marketable securities 5317 4051 Trade accounts. The balance sheet is a financial report that shows the assets of a business ie. Ten years of annual and quarterly balance sheets for CocaCola KO. 35 rows Detailed balance sheet for Coca-Cola stock KO including cash debt. What it owes to others and equity ie. Dow Jones a News Corp company. Forcasts revenue earnings analysts expectations ratios for THE COCA-COLA COMPANY Stock KO US1912161007. Learn more about Zacks Equity Research reports.

See more Zacks Equity Research reports. Dow Jones a News Corp company. The balance sheet is a financial report that shows the assets of a. Coca-Cola Cos property plant and equipment net increased from 2018 to 2019 but then slightly decreased from 2019 to 2020. What it owes to others and equity ie. CONDENSED CONSOLIDATED BALANCE SHEETS - USD shares in Millions in Millions. Coca Cola Co Balance Sheet Annual. COKE Coca-Cola Consolidated Inc. Even though the company has a low cost of debt 168 after looking at the tax benefit the majority of Coca-Colas capital comes from equity so the WACC is much higher than just the cost of debt. Noncurrent assets Sum of the carrying amounts as of the balance sheet date of all assets that are expected to be realized in cash sold or consumed after one year or beyond the normal operating cycle if longer.

The difference between assets and liabilities. For Coca-Cola the liabilities are like given below. Liabilities are the sum which company is obliged to pay. The balance sheet is a financial report that shows the assets of a. Forecasting Balance Sheet Items in a Financial Model. Select the Financial Report. Featured here the Balance Sheet for Coca-Cola Co which summarizes the companys financial position including assets liabilities and shareholder equity for each of the latest 4. THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS December 31 2017 2016 In millions except par value ASSETS CURRENT ASSETS Cash and cash equivalents 6006 8555 Short-term investments 9352 9595 TOTAL CASH CASH EQUIVALENTS AND SHORT-TERM INVESTMENTS 15358 18150 Marketable securities 5317 4051 Trade accounts. Cokes total market value of debt and equity is primarily made up of equity 904. Ten years of annual and quarterly balance sheets for CocaCola KO.