With the help of these values in the balance sheet you can determine the total assets of a business while adding the liabilities. The Importance of Other Liabilities The other liabilities section of the balance sheet shouldnt be of particular note most of the time although the importance of this particular entry on a balance sheet will vary from firm to firm. These include Trading account Profit and loss account and Balance sheet. Notes Payable Notes Payable Notes Payable is a promissory note that records the borrowers written promise to the lender for paying up a certain amount with interest by a specified date. The items which are generally present in all the Balance sheet includes Assets like Cash inventory accounts receivable investments prepaid expenses and fixed assets. Liabilities like long-term debt short-term debt Accounts payable Allowance for the Doubtful Accounts accrued and liabilities taxes payable. When preparing a balance sheet we differentiate between liabilities which must be paid in the short term ie within one year and those which must be paid in the long term ie after one year. Items which appear under the liability side of Balance Sheet are. The division of liabilities into current and long term is done on the same basis as the split of assets into current and non-current assets. As the heading shows the statement is called Balance Sheet.

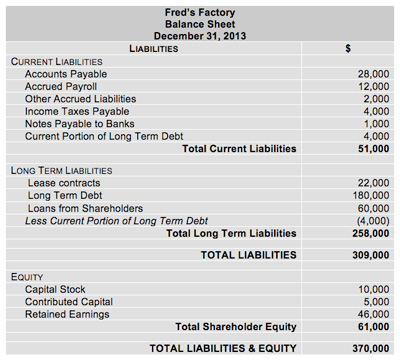

As even a single transaction can make a difference in assets or liabilities so the balance sheet is true only at a particular period of time. It summarises on the one sidethe right hand sidethe assets of the business and on the left hand side the liabilities of the business including. Liabilities are legal obligations or debt and shareholders equity Stockholders Equity Stockholders Equity also known as Shareholders Equity is an account on a companys balance sheet that consists of share capital plus. Liabilities are divided into categories on a balance sheet. Liability is thus an obligation between two parties. Using the ATT NYSE. Then youll see a total figure that shows all current liabilities. Short-term current and long-term liabilities. Current liabilities are a companys obligations that will come due within one year of the balance sheets date and will require the use of a current asset or create another current liability. Capital Long Term Liabilities Loan from bank Mortgage Current Liabilities Sundry Creditors Advance from Customers Outstanding Expenses Income Received in Advance.

Using the ATT NYSE. On the right side the balance sheet outlines the companys liabilities Types of Liabilities There are three primary types of liabilities. Liabilities like long-term debt short-term debt Accounts payable Allowance for the Doubtful Accounts accrued and liabilities taxes payable. The Importance of Other Liabilities The other liabilities section of the balance sheet shouldnt be of particular note most of the time although the importance of this particular entry on a balance sheet will vary from firm to firm. As even a single transaction can make a difference in assets or liabilities so the balance sheet is true only at a particular period of time. T balance sheet as of Dec. Current liabilities can be found on the right side of a balance sheet across from the assets. Not all obligations to make a payment in the future are reflected on the balance sheet. Items which appear under the liability side of Balance Sheet are. To be reported as a current liability the item must be due within one year of the balance sheet date unless the companys operating cycle is longer.

And the Shareholders equity-like Share capital additional paid-in capital and retained earnings. Here is the list of the type of liabilities on the Balance Sheet. The second portion of the balance sheet consists of the companys liabilities -- usually separated into current liabilities and long-term liabilities. The Importance of Other Liabilities The other liabilities section of the balance sheet shouldnt be of particular note most of the time although the importance of this particular entry on a balance sheet will vary from firm to firm. Notes Payable Notes Payable Notes Payable is a promissory note that records the borrowers written promise to the lender for paying up a certain amount with interest by a specified date. Using the ATT NYSE. Liabilities like long-term debt short-term debt Accounts payable Allowance for the Doubtful Accounts accrued and liabilities taxes payable. This is the significance of asset in the balance. Then youll see a total figure that shows all current liabilities. The items which are generally present in all the Balance sheet includes Assets like Cash inventory accounts receivable investments prepaid expenses and fixed assets.

Other liabilities can also include accrued expenses sales taxes payable deferred tax liabilities servicing liabilities or other items. As the heading shows the statement is called Balance Sheet. Accounts Payable Accounts Payable Accounts payable is the amount due by a business to. The term balance sheet items refers to all the records captured in the balance sheet in the form of assets and liabilities as on a certain reporting date. It is important to note that the balance sheet is one of the three fundamental financial statements the other two. It summarises on the one sidethe right hand sidethe assets of the business and on the left hand side the liabilities of the business including. These include Trading account Profit and loss account and Balance sheet. The Importance of Other Liabilities The other liabilities section of the balance sheet shouldnt be of particular note most of the time although the importance of this particular entry on a balance sheet will vary from firm to firm. Capital Long Term Liabilities Loan from bank Mortgage Current Liabilities Sundry Creditors Advance from Customers Outstanding Expenses Income Received in Advance. List the type of items which appear under the liability side of a balance sheet.