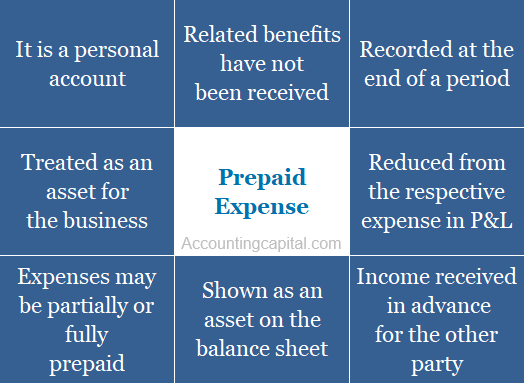

Prepaid expenses are not recorded on an income statement initially. The adjusting journal entry for a prepaid expense however does affect both a companys income statement and balance sheet. Recall that prepaid expenses are considered an asset because they provide future economic benefits to the company. An entity initially records this expenditure as a prepaid expense an asset and then charges it to expense over the usage period. As you use the item decrease the value of the asset. Managing your expenses has never been easier. Ad With Odoo Expenses youll always have a clear overview of your teams expenses. Prepaid expenses in balance sheet are listed as assets too. Prepaid Expenses appear in a Companys Balance Sheet under the Sub-head A Other Current Assets B Short-term Loans Advances C Intangible Assets D Other Non-Current Assets. Before you use a prepaid expense item its an asset.

There is no solving for X. Managing your expenses has never been easier. Thats why prepaid expenses are first recorded as assets in the balance sheet. They are in the asset section and the balance sheet is in balance. Validate or refuse with just one click. Direct Expenses OR ExpensesDirect All expenses which appear in Trading Account except purchases like Labor Power Electricity Expense Factory Loading Unloading Expense Warehousing Expenses Custom Clearing Charges Carriage Freight Cartage Import duty Wages Coal Fuel Coal Gas Water of Factory. A Payment of 1200 made for the insurance premium is shown in the PL AC. Prepaid expenses only turn into expenses when you actually use them. Validate or refuse with just one click. Im not sure what you are associating the accounting equation with.

It is not a math equation. Other examples of prepaid expenses are. Appear in a Companys Balance Sheet under the Sub-head Short-term Provision A Interest Accrued but not due on Borrowings. Managing your expenses has never been easier. Recall that prepaid expenses are considered an asset because they provide future economic benefits to the company. Managing your expenses has never been easier. Direct Expenses OR ExpensesDirect All expenses which appear in Trading Account except purchases like Labor Power Electricity Expense Factory Loading Unloading Expense Warehousing Expenses Custom Clearing Charges Carriage Freight Cartage Import duty Wages Coal Fuel Coal Gas Water of Factory. Prepaid expenses only turn into expenses when you actually use them. The adjusting journal entry for a prepaid expense however does affect both a companys income statement and balance sheet. Validate or refuse with just one click.

Validate or refuse with just one click. The adjusting journal entry for a prepaid expense however does affect both a companys income statement and balance sheet. It is not a math equation. Recall that prepaid expenses are considered an asset because they provide future economic benefits to the company. An entity initially records this expenditure as a prepaid expense an asset and then charges it to expense over the usage period. Appear in a Companys Balance Sheet under the Sub-head Short-term Provision A Interest Accrued but not due on Borrowings. Ad With Odoo Expenses youll always have a clear overview of your teams expenses. Im not sure what you are associating the accounting equation with. As the asset value starts to decrease the prepaid expense is removed from the balance sheet and expensed in the income statement. Prepaid expenses are initially.

Im not sure what you are associating the accounting equation with. A prepaid expense is a type of asset on the balance sheet that results from a business making advanced payments for goods or services to be received in the future. As you use the item decrease the value of the asset. Prepaid expenses is the money set aside for goods or services before you receive delivery. Managing your expenses has never been easier. Managing your expenses has never been easier. Auditor should vouch every nominal account to confirm whether correct amount of expenses is debited to profit and loss account or not. The prepaid expense is shown on the assets side of the balance sheet under the head Current Assets. Instead prepaid expenses are initially recorded on the balance sheet and then as the benefit of the prepaid expense is. There is no solving for X.