Included in this account would be. Equipment is classified on the balance sheet as a. Fixed assets or Property Plant and Equipment The sum of these classifications must match this formula known as the accounting equation. A long-term asset account reported on the balance sheet under the heading of property plant and equipment. In order to transfer net income or loss and owners drawing to the owners capital account. Instead it is classified as a long-term asset. Office Equipment is classified in the balance sheet as Student Answer. This line item value includes real estate warehouses and other structures. Equipment includes machinery furniture fixtures vehicles computers electronic devices and office machines. Property plant and equipment.

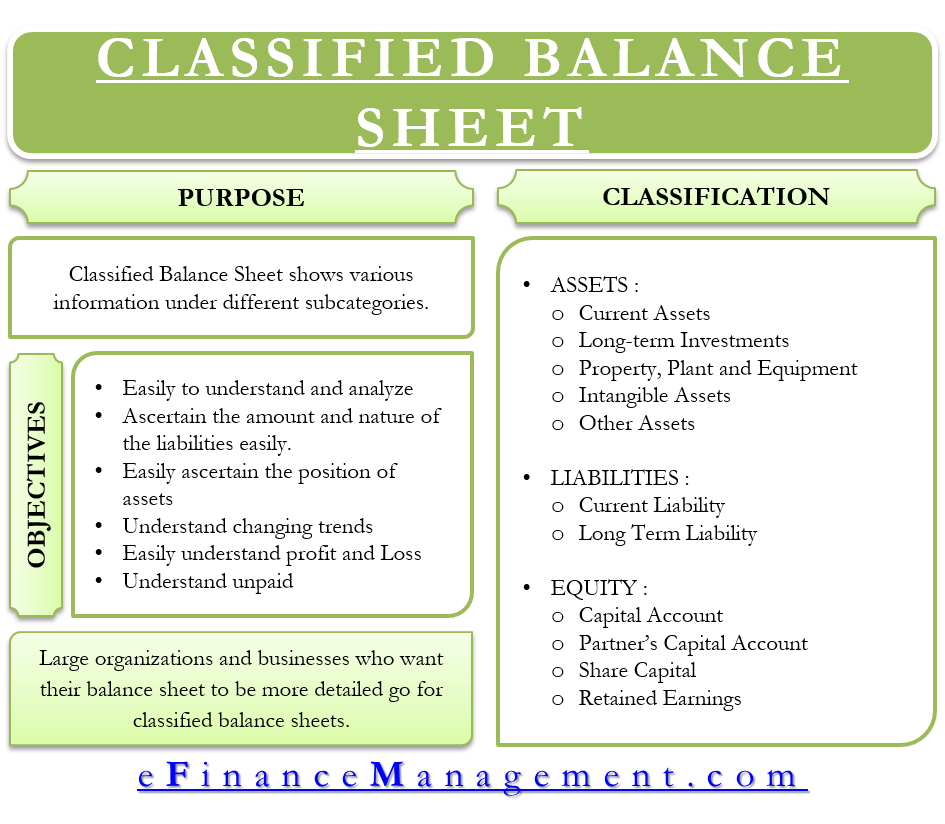

Purchased Equipment Cost A. Closing entries are made. C a long-term investment. Current liabilities those that must be repaid within 12 months are listed first. Presses and other manufacturing equipment. Property plant and equipment. The reason for this classification is that equipment is designated as part of the fixed assets category in the balance sheet and this category is a long-term asset. The most common classifications used within a classified balance sheet are as follows. Office equipment is classified in the balance sheet as. Total assets Total liabilities Shareholders Equity.

Office Equipment is classified in the balance sheet as Student Answer. Furniture Fixtures and Equipment FFE is the movable property companies use in business operations. Property plant and equipment. This line item value includes real estate warehouses and other structures. Purchases on account are debited to purchases. Equipment is classified in the balance sheet as a a current asset. In general equipment belongs on the balance sheet but there are some related expenses such as depreciation that you must also report on the income statement. A long-term asset account reported on the balance sheet under the heading of property plant and equipment. The reason for this classification is that equipment is designated as part of the fixed assets category in the balance sheet and this category is a long-term asset. Office equipment is classified in the balance sheet as.

Property plant and equipment. Rather the expense is spread out over the life of the equipment. Office equipment is classified on the balance sheet as A. FFE can be office furniture fixtures that wont damage a building structure when removed and equipment such as computers needed to conduct day-to-day operations. Each of the following accounts is closed to Income Summary except Student Answer. Office equipment is classified in the balance sheet as assets. Fixed assets can include office equipment furniture tools company vehicles and more. LegalRegulatory Perspective AICPA FC. Equipment is classified in the balance sheet as a a current asset. Furniture Fixtures and Equipment FFE is the movable property companies use in business operations.

Property plant and equipment. The reason for this classification is that equipment is designated as part of the fixed assets category in the balance sheet and this category is a long-term asset. The most common classifications used within a classified balance sheet are as follows. These purchases are considered long-term investments and will depreciate over the course of years. Equipment is classified on the balance sheet as a. Office equipment is classified on the balance sheet as A. Rather the expense is spread out over the life of the equipment. Purchases on account are debited to purchases. Equipment is not considered a current asset. Fixed assets can include office equipment furniture tools company vehicles and more.